Dave got a nasty letter from RITA (Regional Income Tax Authority), the agency that collects local income tax for various communities, including ours. The letter stated that he had not paid his 2012 taxes and that he had better do so and that they were going to use his federal returns to determine his tax liability plus charge him penalties. And if he didn’t pay, they would subpoena him to appear at a hearing.

I meant to call them, I really did, but I forgot. So, they sent him a summons to a hearing, demanding that he appear at city hall on a certain date and time. And he was told to bring CASH. And again he was told that they were going to use his federal return to determine his tax liability.

So, now I was irritated. The tone of the letter was clearly adversarial. I thought about just ignoring this too so that I could see what would happen next but then my adult self stepped in.

I called the number, explained that my husband had died and so could not make it to the hearing (I did actually say that…I know.) The woman who answered the phone politely asked for the date of his death and said “I’ll update our records and I’m sorry for your loss.”

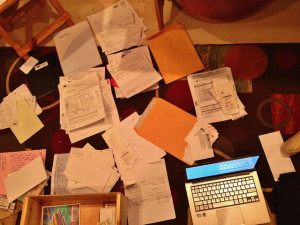

The person was polite, professional, and not snarky. The letters were written with the assumption that the recipient was a deadbeat, refusing to pay taxes. I’m not sure that this is the right tone for the initial contact. I think I threw out the letters or I would post them here for everyone to see. I don’t think I would have cared so much except for the continual repetition of using his federal return. If they were using his federal return, they would have seen that he didn’t have one.

Anyway, Dave is off the hook for failing to pay his local income tax.