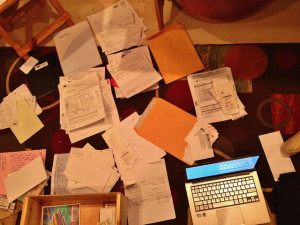

I saw my parents this weekend and my father wanted to discuss his estate matters. He had this list of things for us to do when he dies but I finally asked him if he has an estate lawyer. He said yes so I said, well, this is a fine list but the first thing to do is call the lawyer. He will be able to take care of many of these things for us and tell us what to do.

That’s my advice for everyone. Talk to a lawyer when dealing with estate things. It really does make life easier. When I went to the widow’s support group, there were often widows who were struggling to deal with finances and deeds and taxes and had no idea what they were doing. It’s hard to deal with at the best of times. Those in the group who had hired an attorney were much calmer about the whole thing.

Sheri Peters helped me and she was the best. I can’t say enough good things about her. If you live in northeast Ohio, or at least in Summit or Stark county, use her. Her office is in Monroe Falls.

Congregational Church, State Route 77, Riceville, Crawford County, PA Photos from Survey HABS PA-514